Riding the Waves of Hawaiian Real Estate

Share News:

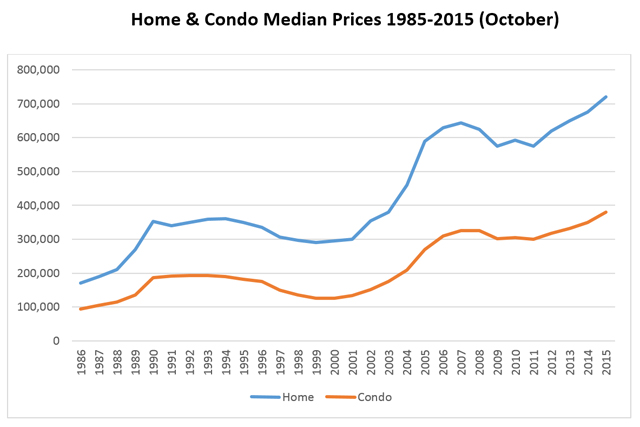

For the third month in a row, median home prices in Honolulu dipped a bit to $715,500 down from $720,000 in October and September’s record high of $730,000. The result is flat year-over-year prices and has resulted in a bit of a buying spree with unit sales up 9-percent from last year. Condos prices were up 1.3-percent over the year to $347,500 with unit sales essentially flat. Days on market? Just 21 days for homes and 22 days for condos.

At the peak of the housing bubble, homes and condo medians were $643,500 and $325,000, respectively. The trough saw median homes and condos fall to $575,000 and $300,000 respectively.

This is why it’s difficult to lose money in Hawaiian real estate if you have the luxury of time. You may be thinking this is true for all real estate. Not really. First of all, the most recent bust in places like Phoenix, Las Vegas and Florida have still not completely recovered. Sure, the best real estate in these areas has, but for example, it’s estimated that 25 percent of Las Vegas mortgages remain underwater – and 10 percent of all mortgages are estimated to be still underwater. Also, outside perennially hot markets like New York City and San Francisco, it’s hard to find locations with the odd consistency enjoyed by Hawaii.

For similar, but unrelated reasons, Hawaii real estate has seen 10-ish year boom-to-bust-to-higher-boom cycles. The Canadians invested and pulled back. The Japanese did the same. The tech-bubble popped. The global economy popped. Today’s Hawaii buyers are newly-wealthy Americans from the tech and banking sectors coupled with an influx of Chinese who are investing heavily in overseas real estate.

These outside influences dip the market and poise it for accelerated growth sooner than many locations.

Within the islands there are two markets. The local market for primary residences tied to mortgages and the second home market with much fewer mortgages. Local market pricing is tied to interest rates as it is elsewhere. Wage stagnation means that primary residence buyers have a set payment they can afford that’s unlikely to drastically change over time. If interest rates rise, their budget won’t increase, so home prices will dip to meet buyers’ purses.

The less-heeled second home buyer is also influencing the local market more these days. The advent of B&Bs, Airbnb, VRBO.com and the like have spawned ways for second homeowners to make a second home pay. Many of these homes are taken from the less glamorous, less expensive local housing stock. This ability to cash-in in real-time adds value to homes and makes them increasingly less-affordable to local residents. Unfortunately, these second home “innkeepers” don’t offer long-term rental properties to local or long-term temporary residents (like students, contract workers or retirees). They offer day-accommodations to vacationers that wreak the most havoc on properties and neighborhoods. (You may guess I’m not a fan of the “sharing economy.”)

The less mortgage-reliant second home market is dominated by expensive properties and tied more to asset liquidity in response to larger market or personal forces. Its peaks and troughs have little to do with local issues. For example, in the 1980s and early 1990s the Japanese economy was booming and they were buying global real estate. Hawaii, long a favorite destination for Japanese tourists of all economic ranges, saw limos driving around tony areas with Japanese passengers surrounded by suitcases of money. Hawaii real estate was considered a safe bargain at a time when some Tokyo real estate was selling for $139,000 a square foot!

And then the Japanese economy entered its “lost decade” where housing and stock prices lost trillions of value. This caused the Japanese to sell assets including real estate throughout the decade (and depress local prices). Some large development projects were literally sold for pennies on the dollar by cash-strapped developers.

Over the decades, differing details subjected different groups to the same fate, taking Hawaii real estate along for the roller coaster.

The regularity of this cycle (as well as the scarcity of physical land) has consistently jumped prices in the run-ups to a burst. But unlike a lot of busts, Hawaiian busts don’t erase all the gains made in the run-ups. For example, from 2000 to 2007, prices more than doubled and yet the “bust” only lopped about 15 percent off the top before resuming their charge north; up 21 percent just four years into the current cycle.

In another example, the prior “crash” saw median home prices “crater” in 2000 to $295,000. Within three years, a new record high of $380,000 was reached before ultimately peaking at $643,500 in 2007.

I’m not saying Hawaii is a foolproof investment (insert usual caveats about past performance not a guarantee of future returns, etc. so you don’t sue me). Certainly unrelated personal financial crises can lead to problems too. A recent “fire sale” saw a $1.2m condo sell for under $1m because the owners had mortgaged it to the hilt and the bank was poised to foreclose. The macro economy isn’t going to solve blips like that in any market.

But Hawaii is certainly an interesting real estate market made all the more pleasant by trade winds and Mai Tais on the beach. In the market? Give a shout. As they say, “I know people.”

Remember: Do you have a secondshelters.com location you’d like to see featured? I travel quite a bit and enjoy poking around real estate. Realtors, have clients who’d like to document their second home journey? Shoot Jon an email. Marriage proposals accepted (they’re legal)! sharewithjon@candysdirt.com.