Paris is Burning … a Hole in Your Wallet

Share News:

A Wallet-Emptying View of Sacre-Coeur from Champs Elysées Penthouse

You have to hand it to the French. Here in the US, we’re thrilled if we can cobble together real estate sales and rental data going back a few years. In preparation for my trip to Europe on Friday, I took a look at what data was available in Paris. A lot. Easily downloadable are the purchase and rental data for Paris from 1200 to 2016. Yes, the year 1200 … 816 years of data at your fingertips. The data is tracked by the Conseil Général de l’Environnement et du Développement Durable (CGEDD). Quite a mouthful.

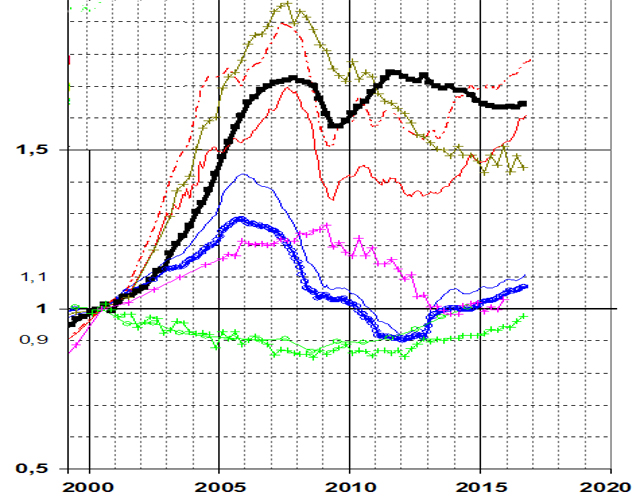

Looking back a bit more reasonably to 1965, there are some interesting comparisons to be made. First of all, the average property in the US as measured by Freddie Mac and Case-Shiller was consistently higher than in France from 1965 until 2001, when the costs merged. From that point onwards, French residential real estate has greatly outperformed the U.S. market.

Ratio Comparison. Thick Blue Line Represents U.S. and Thick Black is France (Source: CGEDD)

The global recession? France weathered it better. After a huge run-up in prices beginning in 2001, prices topped and began to fall in December 2007 and hit rock-bottom in mid-2009. Their real estate recession lasted just 19 months while the U.S. continued downward, bouncing at rock bottom for nearly two years before finally beginning to recover in early 2013, a total of seven years.

How did France get off so easily? Their tight mortgage laws didn’t allow for the speculative lending that was rampant here. Turns out enormous down-payments and strict lending create a more stable real estate market (shocking, right?).

Since their most recent high in mid-2011, French real estate has drifted slightly downward and has flattened since mid-2015. So you’re likely to pay less today than you were in 2011, factor in the recent devaluation of the Euro from an historic $1.30 level to today’s $1.05 and it’s not the worst time to be poking around the French countryside for a second shelter.

Today, in the center of Paris, the average cost per square foot is currently €880 or $944. But as recently as 2014, a stronger Euro would have translated that €880 into $1,215 per square foot. Currency fluctuations alone account for a $271 savings per square foot. Not bad.

In the coming weeks, I have appointments to view Paris apartments ranging from $910 per square foot all the way up to a wallet-quaking $4,750 per foot. The difference in price is universal … location … view … building.

For example, this 3,250-square-foot penthouse with views of the Eiffel Tower, Arc de Triomphe, and Sacré-Coeur from its 2,800-square-foot terrace. It’s a skip from the Champs Elysées and will set you back $4,444 per interior square foot or $14.45 million. Merde!

Remember: When I’m not stirring up trouble in Dallas, Texas or Honolulu, Hawaii for Candysdirt.com and SecondShelters.com, I’m off scouting interesting locations for a second home. In 2016, my writing was recognized with Bronze and Silver awards from the National Association of Real Estate Editors. If you’re a Realtor with second home clients who’d like me to feature their journey, shoot me an email sharewithjon@candysdirt.com